Introduction

Understanding the property registry process in Pakistan is essential for anyone buying or selling real estate. Property registry legally transfers ownership from the seller to the buyer and protects both parties from future disputes. Whether you are purchasing a house, plot, or commercial property in Lahore or Islamabad, following the correct registry and mutation process ensures lawful ownership. This guide explains the step-by-step property registry procedure, required documents, and common mistakes to avoid during property transfer in Pakistan.

What is the Property Registry in Pakistan?

Property registry is the legal process through which ownership of a property is officially recorded with government authorities. Once a property is registered, the buyer’s name is entered into official land records, confirming legal ownership.

Without proper registry:

Ownership remains legally incomplete

Property disputes may arise

Future resale becomes difficult

Therefore, completing the property registry process in Pakistan is mandatory after purchasing real estate.

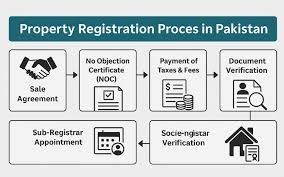

Step-by-Step Property Registry Process

The property registry process generally includes the following steps:

Verification of property documents

Agreement between buyer and seller

Payment of stamp duty and taxes

Preparation of registry documents

Submission to the registrar’s office

Biometric verification of the buyer and seller

Issuance of registry record

These steps ensure transparency and legal protection for both parties.

Required Documents for Property Registry

To complete the registry process, the following documents are typically required:

Original sale deed

Copy of CNIC (buyer & seller)

Proof of property ownership

Property tax clearance certificate

Approved site plan or allotment letter

Stamp paper and registration fee receipt

Ensuring accurate documentation is critical to avoid delays or rejection during the registry.

Property Registry in Lahore vs Islamabad

While the overall procedure is similar, there are slight differences in registry systems:

Lahore

The property registry in Lahore is managed through the Punjab Land Records Authority (PLRA). Biometric verification and digital land records have improved transparency and reduced fraud.

Buyers interested in registered properties can explore houses for sale in Lahore with verified documentation.

Islamabad

In Islamabad, the property registry is regulated by the Capital Development Authority (CDA). CDA ensures compliance with zoning and development regulations before approving the registry.

You can review legally approved properties in Islamabad to understand registry requirements specific to the capital.

Role of Mutation in Property Transfer

Mutation is the process of updating land revenue records after the property registry. While registry transfers ownership, mutation ensures the buyer’s name appears in government revenue records.

Key points about mutation:

It follows the property registry

Required for tax and utility records

Helps prevent ownership disputes

Both registry and mutation are essential for complete legal ownership.

Common Mistakes to Avoid During Registry

Many buyers face issues due to avoidable mistakes, such as:

Not verifying land records

Incomplete documentation

Skipping biometric verification

Paying incorrect stamp duty

Dealing with unauthorized sellers

Avoiding these mistakes helps ensure a smooth and legally secure transaction.

How ULAND Helps in Secure Property Transactions

ULAND Pvt Ltd assists buyers and sellers with secure, transparent property transactions in Lahore and Islamabad. Our team verifies documents, guides clients through registry and mutation, and ensures compliance with legal requirements.

For professional assistance with buying, selling, or registering property, contact Uland Pvt Ltd for expert support.

Fees and Taxes Involved in Property Registry

During the property registry process in Pakistan, buyers must pay certain government charges. These typically include stamp duty, registration fee, and capital value tax. The exact amount varies depending on property value and location, such as Lahore or Islamabad. Paying correct fees through official channels is important to ensure the registry is legally valid and properly recorded in government land records.

Conclusion

The property registry process in Pakistan is a crucial legal step that safeguards ownership rights and ensures transparent real estate transactions. By understanding the registry and mutation procedures, verifying documents, and following official guidelines, buyers can avoid legal complications. Whether investing in Lahore or Islamabad, a proper registry is essential for long-term security and peace of mind.

For Legal Documents Required to Buy Property in Pakistan, see our process “https://uland.com.pk/legal-documents-required-to-buy-property-in-pakistan/”

For Legal & Tax guide, see our process “https://uland.com.pk/smart-legal-tax-investment-guide/”

For Property Fraud Guide, see our process “https://uland.com.pk/trusted-property-fraud-guide-for-overseas-pakistanis/”

For Legal Checklist see our process “https://uland.com.pk/uae-pakistanis-investing-in-property-in-pakistan/”

For Registry is especially important for overseas buyers — see our “https://uland.com.pk/best-commercial-property-investment-overseas/”